Gold Price China

(Chinese Yuan)

Conversion : 1 troy ounce = 31.1034768 grams

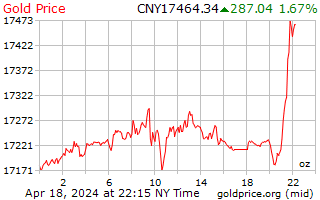

Chinese Yuan 24 Hour Spot Gold and Silver Price

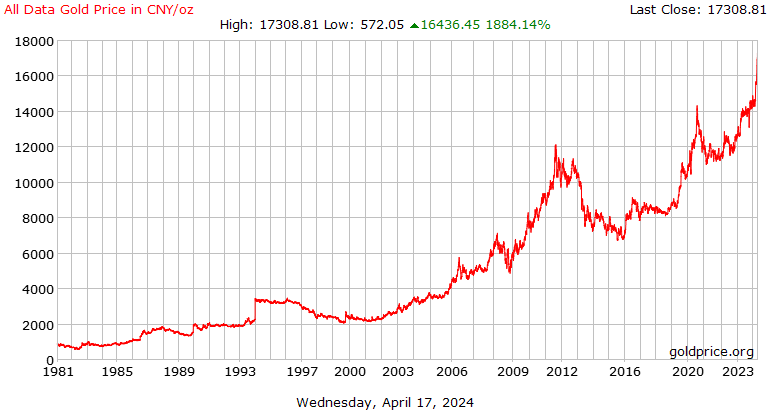

Chinese Yuan Gold Price History Charts

To learn about our gold price data

Gold Price China

As the world’s second largest economy, China plays a very important role in global trade. China has also become the world’s largest gold market, and demand for gold in the country could potentially continue to increase. China has numerous gold exchanges, and investors in the nation may look to gold as an investment for its price appreciation potential and as a hedge against declining currency values, slowing real estate markets and stock market volatility.

Gold prices in China may be quoted in the local currency, the yuan, or in other key currencies such as U.S. Dollars, euros or Great British Pounds. The price of gold is typically quoted per ounce, gram, taels or kilo.

The renminbi is the official currency of the People’s Republic of China. The yuan is the basic unit of the renminbi, although yuan is often used when referring to the Chinese currency. The currency is issued and controlled by the People’s Bank of China. The yuan has become increasingly popular on the international stage in recent years, and it is also now an officially recognized global reserve currency.

One of the most popular gold bullion products to come from China is the Chinese Gold Panda coin. These coins are produced by the Chinese Mint and feature a new obverse design each year. These coins are the official bullion product of the People’s Republic of China, and are issued annually in both gold and silver. Unlike many other highly popular bullion coins, the Chinese Panda is issued in various weights by gram as opposed to ounces. Some of the weights available include 1 gram, 3 gram, 8 gram and 30 gram. The change from ounces to grams took place in 2016.

Due to the coin having several smaller weights available, these coins may be relatively more affordable to investors on a tight budget. The coins are considered good, legal tender and carry varying face values based on weight.

For those looking for Chinese gold bars, the 5 Tael Gold Bar may be a good choice. These gold bars contain 6.01 ounces of 999.9 percent fine gold, and they are one of the most widely traded gold biscuit bars in Asia.

Chinese gold bars may potentially offer a per-ounce cost savings compared to bullion or collectible coins. Gold bars can be bought in larger weights than coins, and may be ideal for larger investors or those looking to acquire more total ounces of gold.

China is a major miner of gold, and the nation is reportedly the world’s largest gold producer by a wide margin. China’s gold mining industry has received increased foreign and domestic investment and the number of projects has increased as well as more gold discoveries have been made. Some of the largest foreign investors in the Chinese gold mining industry include Canada and Australia.

The majority of Chinese gold output remains in the country, and is used for jewelry and manufactured items.