Gold Price Europe

(Our Euros)

Conversion : 1 troy ounce = 31.1034768 grams

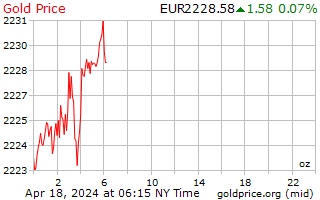

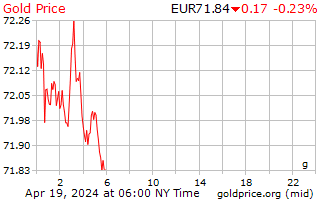

Our Euros 24 Hour Spot Gold and Silver Price

Our Euros Gold Price History Charts

To learn about our gold price data

Gold Price Europe

The European Continent covers a land area of some 3,930,000 square miles. Europe is divided into about 50 sovereign states, with the Russian Federation being the largest and most populous on the continent. Europe has a population of approximately 741 million, making up a significant portion of the global population. Western civilization gets its roots from Europe, and the region has played a major role in global affairs.

The European Union is a political and economic union in Europe of which 28 European states are members. The EU has enacted various policies to ensure the free movement of people, capital, goods and services through its internal market. This internal market uses a system of standardised laws that apply in all member states to facilitate free trade. The EU established a monetary union in 1999, and the union began to use the shared currency, the euro, in 2002. 19 member states use the euro, while other member states have elected to keep their currencies.

The euro is the world’s second most widely traded currency behind the U.S. Dollar. The euro can be subdivided into 100 smaller units of currency called cents. The euro is also one of the globe’s largest reserve currencies, and its use as a reserve currency is second only to the dollar. The total value of euro coin and paper currency in circulation has surpassed the dollar.

The euro is issued and controlled by the European Central Bank. The ECB was established in 1998 through the Treaty of Amsterdam, and it is headquartered in Frankfurt, Germany. The ECB has several key responsibilities outside of currency issuance and maintenance. One of the central bank’s primary objectives is to promote price stability within the region. The ECB has an interesting set up, in that it resembles a corporation with member states acting as shareholders.

If you are in Europe, the price of gold may be quoted in euros or in the currency specific to that country if it does not use the euro. Quotes may also be readily available in other major global currencies including U.S. Dollars, Great British Pounds, Japanese Yen or Canadian Dollars. Spot gold prices are typically are quoted by the ounce, gram or kilo.

The European Continent has numerous government mints and other refineries. Bullion bar, coin and collectible products are available in many countries, and can add diversification to any metals portfolio or coin collection. Many of these mints and refiners produce products that celebrate the country or region’s history, key figures and other manners of historical importance.

Investors in Europe may look to buy and hold gold coin and bullion for all of the same reasons as investors anywhere else. The metal has a very long history in the region as a reliable store of wealth and value. It can add further diversification to a portfolio, and may potentially provide a hedge against numerous economic and geopolitical issues such as inflation, deflation or declining paper currency values.