Gold Price Recap: May 2 - May 6

Happy Friday, traders. Welcome to our weekly market wrap, where we take a look back at these last five trading days with a focus on the market news, economic data and headlines that had the most impact on gold prices and other key correlated assets—and may continue to into the future.

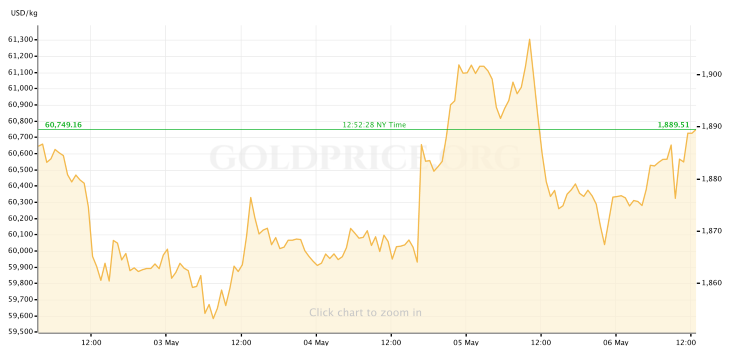

Gold prices are closing out the week moderately lower than where first offers were made on Sunday evening, but having recovered from Monday morning’s collapse and steadied out a tumultuous mid-week stretch that came as the Fed tossed markets into a spin-cycle of volatility.

So, what kind of week has it been?

As expected, the dominant market mover this week was Wednesday’s policy announcements from the FOMC and Fed Chair Jerome Powell’s pursuant Q&A; not just for the gold market, but for financial markets as a whole. Between the formal statement and the Chair’s press conference, the Federal Reserve made three key announcements: the central bank hiked interest rates by +0.50%; announced that they would begin reducing the Fed’s $9 trillion balanced sheet in June; and Powell clarified that, while the FOMC themselves anticipate additional “double” hikes of +0.5% to come this year, the possibility of a 75 basis point hike (which has made the financial media rounds in recent weeks) is not even on the table.

The first two announcements were in-line with the consensus expectations of investors and analysts, and serve to continue the Fed’s assertive efforts to slow down the US economy—in a safe and controlled manner—in order to cool inflation which sits near 40-year highs. Raising Fed rates raises the overall cost of capital and borrowing, slowing spending and expansion activity; by allowing their balance sheet to “run off”—that is, by not purchasing new bonds to replace those maturing—the Fed is easing off the accelerator further by withdrawing some of its gargantuan support of the bond market.

Both moves also have the effect of pushing yields on US Treasuries higher, which means that, historically, such moves are expected to weigh heavily on gold prices. However, as we pointed (in Monday’s preview piece) might be the case, the announcements that came down on Wednesday seemed to be pre-baked into gold prices after last week’s (and Monday morning’s) slide below $1900/oz. Spot prices for the yellow metal did not, as one could’ve imagined being the case, drop with the FOMC decision at 2pm EDT.

In fact, possibly because of the third key point made by Jerome Powell & Co. on Fed Day, gold prices took a solid step higher following the announcements and then, after some brief chop at the start, rose sharply during the Chair’s Q&A. Having the Fed (via Powell) disavow any likelihood of a +0.75% hike was seen as a more cautious, more dovish shading than was expected from the FOMC by investors and economists. As a result, the gold market reacted happily to the suggestion that while monetary tightening is still set to proceed at fast clip, it isn’t going to keep getting more aggressive with each meeting: By the end of Powell’s press conference, gold prices had gained more than $15/oz to sit just shy of $1890; in the overnight sessions, as Asian markets had a chance to digest the move, gold continued rising higher and returned to $1900 for a time.

Gold was far from the only asset to react positively to the FOMC’s Wednesday announcements. In what looked a bit like a repeat of 2021’s “re-opening and reflation” trades, gold prices were joined on the up-and-up by an afternoon surge in US stock markets—which saw all three key indexes gain roughly 3% on the day—and climbing bond prices, which brought the benchmark 10-year Note’s yield down from 3%. The clear sentiment among the marketplace, or at least among the investors and managers that chose to be the most active in it, was a feeling of confidence in Powell’s pronouncements that the Fed, buffered by a very strong US labor market and the ability to be nimble in its policy implementation, can bring the economy in for a “soft landing” that sees inflation slowed without tipping the US economy into a recession.

There started to be some cracks in this optimistic support for markets, starting with some instability in Europe’s Thursday morning trading. By the time US markets opened for cash trading on Thursday morning, with no new information to trade on, sentiment had gone fully in reverse: Now keenly aware of the risk that the Fed’s fast pace of “quantitative tightening” very well could sink the US into another recession of indeterminant length or depth (and inflation is still, for now, very high,) investors fled en masse in to USD cash positions, spiking the US Dollar ever higher. In reaction, gold prices fell steadily through the morning, as the bond market regurgitated most of Wednesday’s gains and sent the 10-year yield back above 3% (where it remains at the week’s end.) Gold spot collapsed back through $1900 before finding support around $1875/oz. Once of the positive signals for gold markets this week is certainly the demonstration that not only does the yellow metal maintain this support from buyers, but the line of holding appears to have moved up the x-axis by $10 or so. US stock markets crumbled on Thursday under this pressure from uncertainty about the Fed’s ability to stick the landing, and from a rampaging US Dollar and new nights in Treasury yields, turning in their worst single-day performance since 2020.

On Friday, the market moves have been less frenetic, but the stress that bubbled to the surface on Thursday remains. Gold prices, however, appear to be getting some amount of a tailwind out of the market’s risk aversion this time. While the 10-year yield tops 3.1% (at the time of writing) and US equity markets have slid another 1% and more, gold spot prices have risen moderately since Friday morning’s open. Heading into next week, which has a full dance card of appearances from FOMC officials who will do their best to turn investors back to the plucky mood of Wednesday, gold appears to be heading into the weekend having re-consolidated a steady base camp from which to climb, given the right motivation.

For now, traders, I hope you can get out and safely enjoy your weekend for the next couple of days. After that, I’ll see everyone back here on Monday for our preview of the week ahead.