Consumer Sentiment Shows Americans Still Have a Positive Outlook

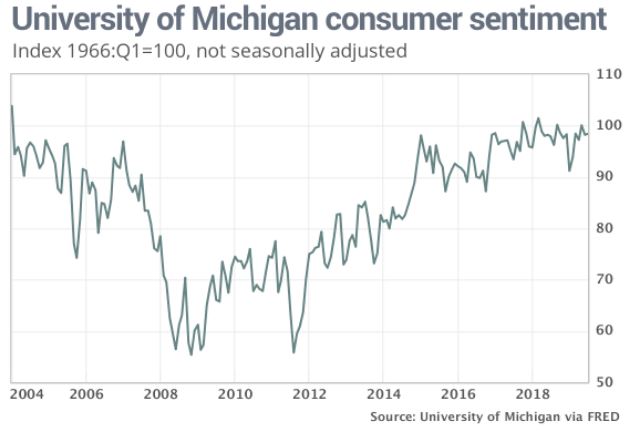

US consumer sentiment improved by a thin margin with the index increasing from 98.2 in June to 98.4 in July. This increase was in line with forecast and marks 5 months of the index staying within a 2.8-point range. Earlier last year marked the highest consumer sentiment since 2004 and we are slowly creeping towards that figure again.

Consumer Sentiment Data

With unemployment at multi year lows there seems to be some fuel left in the US economy to help overcome the weaker global growth. Stock markets are at all-time highs also adding more steam to the US economy. Expectations for personal finances rose to 136 and marks the highest level since 2004. Richard Curtin, director of the University of Michigan consumer survey explains that “Favorable trends in personal finances remained widespread … These favorable financial expectations were supported by gains in household incomes and wealth.”

Five-year inflation expectations increased to 2.6 percent in July vs 2.3 percent in June. June’s reading of 2.3 percent matched record lows. Consumers expect 2.6 percent inflation over the coming year.

Gold Price Action

Williams speech during yesterday’s trading indicated that a 50-basis point cut may be in the picture. NY Fed walked back those comments saying they were educational rather than something that should be taken as an indication to the market. This caused the Fed Funds Futures Market to favor the 25-basis point hike again. Yesterday, after Williams initial speech, gold went and tested news highs for this cycle as the Fed Funds futures priced in a 70 percent chance of a 50-basis point hike. After walking back the comments, there is only a 40 percent chance of a 50 basis point hike and a 60 percent chance of a 25 basis point hike. President Trump, who is in favor of rate hikes to help boost the economy said he liked William’s first set of comments better than the second set.

I like New York Fed President John Williams first statement much better than his second. His first statement is 100% correct in that the Fed “raised” far too fast & too early. Also must stop with the crazy quantitative tightening. We are in a World competition, & winning big,...

— Donald J. Trump (@realDonaldTrump) July 19, 2019

Gold caught a strong bid on the first set of comments and has fallen off quite quickly after the comments were reversed.

Consumer Sentiment data was a mixed bag and did not cause too much of a ripple in gold, dollar or rates markets. These markets are mostly focused on the Fed, and the Fed news mostly overshadowed the consumer sentiment data. Watch out for more Fed news in the coming weeks, as more dovish talks will give gold more reason to go higher.