Federal Reserve Weary About the Condition of the Economy

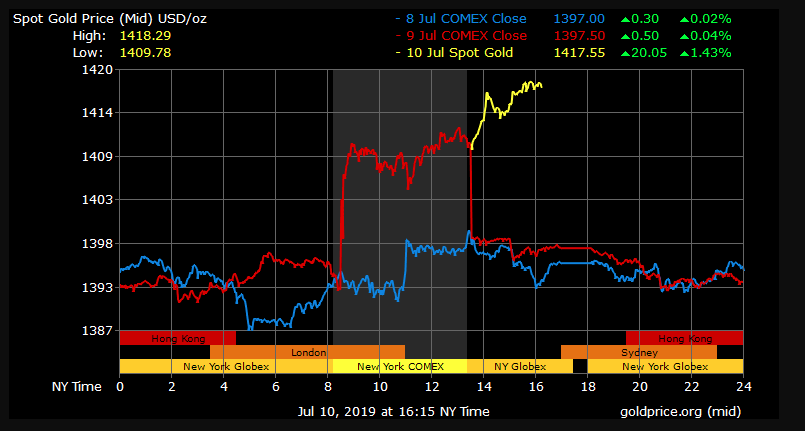

Stocks hit new highs today as the Fed has indicated that an interest rate cut is imminent, Fed Funds futures agree. During last months meeting the Federal Reserve held rates steady waiting to see more economic data that would indicate the economy is slowing down. Weaker shipments, lower profit forecast, slowing manufacturing activity and overall weaker global growth helped prove the case that it is time to start the rate cut cycle. The big trigger for gold were Powell’s comments that came earlier this morning, igniting a gold rally of $15 if just a few minutes. Gold traded up another $10 after the initial comments, including the $2 bid we had following the minutes.

Fed Comments

Today's Powell comments were indicative that he is weary about the state of the economy. Powell told the House Financial Services Committee earlier today that “The bottom line for me is the uncertainties around global growth and trade continue to weigh on the outlook.” The minutes cited various reasons why lower interest rates would help the overall economy. Some said it would help the weak inflation number, others said it would help cushion further adverse shocks to the economy. Overall it looks like next meeting is a go.

When and How Much?

The big question at this point is how much to cut rates and when the first rate cut would be. At the close of Tuesday’s trading Fed Funds futures indicated a 97 percent chance that we would lower rates by 25 basis points with a 3 percent chance that we would lower by 50 basis points. Following the press conference and today’s minutes the chances of a 50 basis point cut has jumped substantially to 25 percent. Futures show that there is a 60 percent chance that the Fed will raise rates by a total of 50 basis points within the next two meetings.

Golds Reaction

Gold caught a bid while yields and dollar sold off in anticipation that the Fed Minutes would mirror Powell’s comments to the House Finance Committee earlier in the day. When the Federal Reserve released the minutes, trading was much more muted than one would expect, Gold did not gap up and the dollar and rates held steady.

Following the minutes, we have had a slow grind up in gold and a slow and steady sell off in the dollar and rates. Gold is up about 2 dollars in about an hours trading following the release showing that the minutes were mostly priced in from the comments. The big gap up for gold was after the comments were released earlier this morning, the comments indicated to the market what the minutes had in store. Following this morning’s comments gold gapped up almost $15 in just a few minutes of trading while the dollar and yields followed the same pattern (Yields and Dollar down). Look out to see if the Fed indicates further economic weakness, this would further the case for a 50 basis point hike, on that news gold would most likely catch another strong bid.