ISM Non-Manufacturing PMI Shines Some Light on the US Economy

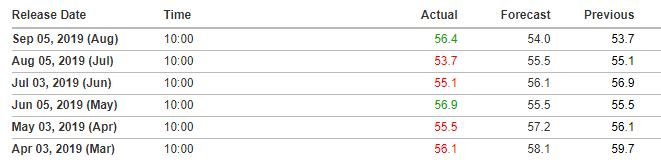

The Institute for Supply Management’s (ISM) Non-Manufacturing PMI report shows that economic activity in the United States service sector beats expectations, 56.4 actual vs 54 expected, and a significant improvement from July’s reading of 53.7. Non-Manufacturing PMI is coming off a 2-month slowdown, this data point is a sign of strength for the US service sector.

6 months of ISM Non-Manufacturing PMI data

Economic Implications

The strong ISM data comes as a sign of relief to the overall economy after Tuesday’s worse than expected ISM Manufacturing PMI, 49.1 actual vs 51.1 expected, down from 51.2 in the previous month. Overall, economic data has not suggested the need for more rate cuts in the upcoming FOMC meetings. The main thing that has pushed the FOMC into cutting rates has been the US/China trade war. Economist believe that an elongated trade war can slow down economic activity and push the US into a recession, the FOMC is trying to get ahead of that.

Gold’s Reaction

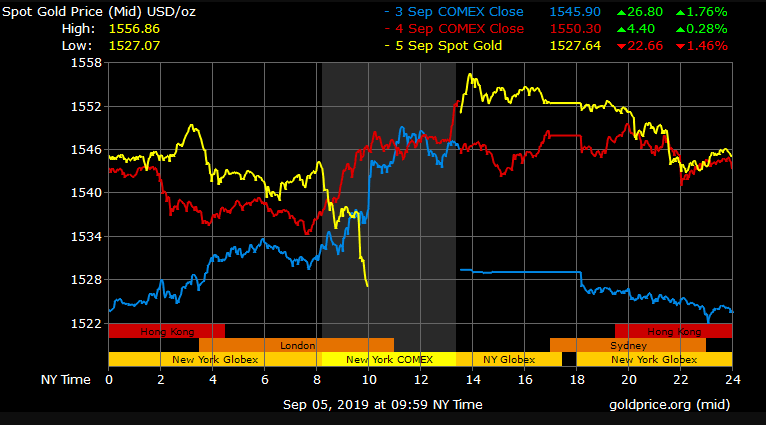

Gold had sold off in early trading as a result of the newly planned trade discussions between US and China, these discussions will take place in Washington, early in October. This piece of news lowered the chance of a 50-basis point cut in the upcoming FOMC meeting and makes it all but certain that we will see just a 25-basis point cut. After the ISM Non-Manufacturing beat, gold had more of a reason to sell off, down $40 from the daily high before recovering $10 to $15. Given the upcoming meeting is almost certainly going to be a 25-basis point cut, indications for the following meeting will be a catalyst for gold. If trade talks between the US and China go poorly, we will most likely see gold move back towards cycle highs.