Gold Price Slides as Retail Sales Gives Hope to the U.S. Economy

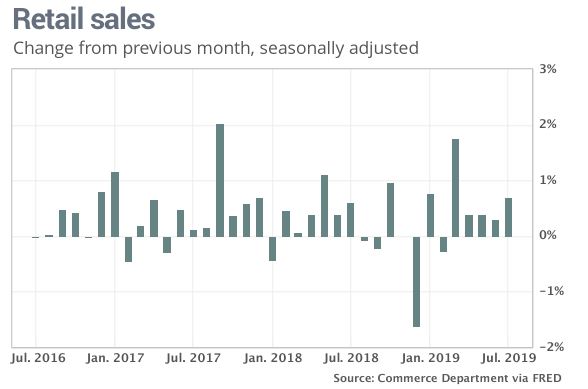

Retail sales increased by 0.7 percent in July compared to a month prior, significantly better than what economists expected. Retail sales measures purchases at stores, restaurants and online. If you exclude auto sales and gas, retail sales were up 1.0 percent in July. In the May though July period, consumer spending increased by a whopping 1.8 percent when compared to the three months prior. Positive retail sales sent gold down about $5 before recovering most of the losses in the ensuing hour.

Online Sales

One big boost to the retail sales figures was from online shopping which increased by 2.8 percent in July. This boost was greatly attributed to Amazon’s Prime Day. For Amazon the two-day shopping event surpassed its sales of Black Friday and Cyber Monday combined. Amazon says that it was “once again the largest shopping event in its history”. Other retailers were able to piggyback this event as they offered deals to compete with Amazon.

Retail Sales Figures

Consumer spending accounts for two thirds of the economic output. Sales at department stores, restaurants and electronics stores also bolstered the retail sales figures. Gas sales were up 1.8 percent which is helped by the rise in crude prices. Low unemployment and consumer confidence are helping to keep the economy afloat while the wider economic outlook remains uncertain.

China and Germany are seeing their economy slow down making US economists worry about US growth. Trump deciding to hold off on the proposed September 1st tariffs has given some relief to retailers. Retail sales were not all positive, sales at auto dealers fell 0.6 percent while sales at sporting goods, books and music stores fell even further.

Gold’s Response

Gold has returned to its glory days rising more than $200 in about two months. Positioning around gold futures and ETF’s is creeping up on all-time highs and shows no signs of slowing down. Gold dipped about $5 following the retail sales figures but has quickly regained that loss and is now trading higher.

Even though the retail sales figures were strong, gold has displayed it’s resilency over the past few months. Traders are using gold as a duration hedge on their bond portfolios, which have taken a pretty stong beating as rates are going towards zero. As I have said before, keep a close watch on the Federal Reserve, further indication for lower rates will most likely send gold higher.